Knock first, walk into my office, open my safe, pick any diamond and I’ll give you a price on it. It’s all for sale. Diamond dealers and jewellers trade in diamonds – no one is investing for the long run. Why then are diamonds being marketed as the greatest investment of all time? Sales talk.

Although I believe diamonds are the holy grail of gemstones for jewellery, I never encourage customers to buy them solely for investment purposes. Google “diamonds as investment” and you’ll find hundreds of articles, with just as many opinions. The following is just my opinion and it’s in your best interest to read widely on the topic before making any investment decisions. Yay, or nay.

Consideration 1: Price

Unlike most commodities, diamonds don’t have a readily available transparent, open-market price you can verify on a platform such as Bloomberg or Reuters. Determining the “real” value of a diamond is a grey area. It’s traded globally on many levels (mines to polishing factories to diamond dealers to diamond brokers to jewellers etc) and you’ll always end up paying someone’s cost + profit (Not the elusive “wholesale market value”). As simple as that. The further from the source you buy, the higher the price will be. Even though your BFF’s diamond dealing uncle will surely have your best interest at heart… he will probably not ask you any price below his cost price. What did he pay? Who knows! Probably too much. There is NO MARKET VALUE.

The only way to counter this is to do your research properly and ensure that you are paying the best possible price. Very few top tier resellers of diamonds (major factories) will deal directly with the public unless you are willing to buy sizable parcels of diamonds.

By FAR the most expensive channel to buy a diamond through is a traditional mall based jeweller. We all like to feel special, right? When you kick back at a jewellers stunning, grained mahogany desk, surrounded by expensive silk curtains, sipping flat champagne – just remember… you’re paying for the experience AND for the champagne of the 10 guys before you who had the sense to leave after the glass of champagne only to never return. Bless their souls. Drink the champagne and convince yourself that you’ll have a desk like that someday, but leave.

Consideration 2: Growth expectations.

Although diamonds have historically been a good and stable store of money, very few players in the diamond industry are of the opinion that unparalleled growth in diamond prices is in the near future. Paying too much initially will also mean that you need many years of growth in diamond prices to be able to merely sell the diamond back to a diamond dealer for the price you paid.

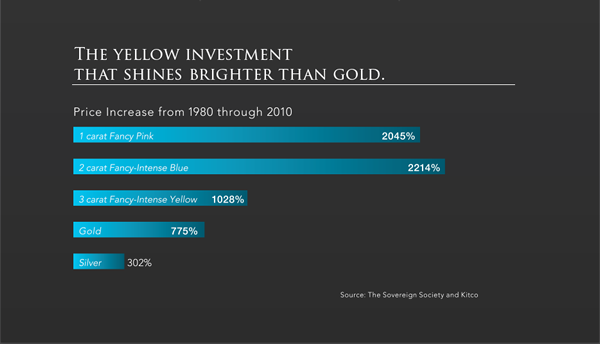

The natural supply of diamonds on planet earth is not running out by any means. Don’t bargain on a massive shortage any time soon. Charts like the following are all over the internet, and although 2045% (best growth category) over 30 years seems like a lot, its actually just over 10% per year annualized.

My Humble Opinion

When looking beyond their brilliant luster and shine diamonds are a tradable commodity – not an investment. If you wish to invest in diamonds, take the same approach you would to collector’s coins. Buy something that is extremely rare. Unless you are buying a unique, coloured (other than yellow) diamond, you’ll probably be better of investing your hard earned money elsewhere if you want a great return on investment.

August 2015 UPDATE: The Rand seems to be in freefall and since diamond prices are fixed in US$ they offer a good way to lock your money into a US$-based commodity. Although I’m still not of opinion that you’ll see exceptional US$ growth diamonds are an excellent Rand hedge.

If you would like to learn more about the sane approach to buying a diamond for jewellery (or otherwise), why not read my brand new e-book: Buying A Diamond Like A Diamond Dealer?

{{cta(‘11654f6a-9aa3-4e50-b5c9-77b00068bd8a’)}}